Special Report: Cap hasn’t slowed spending in North Fork school districts

When state lawmakers approved a 2 percent cap on annual tax levy increases in 2011, they said the legislation was designed to control school district spending and ease the burden on taxpayers.

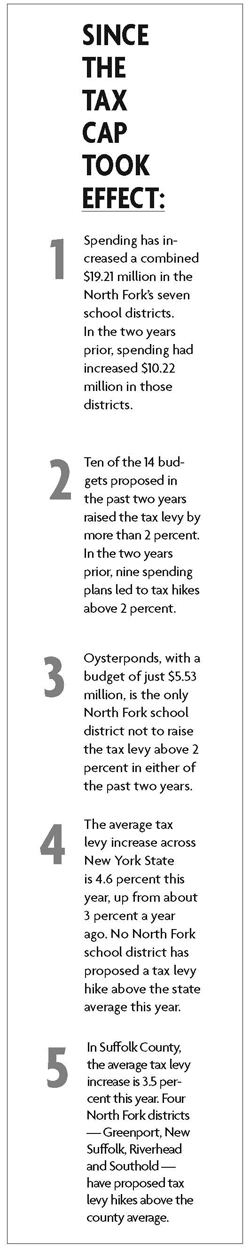

Since then, a Times/Review Newsgroup analysis has found, spending in most North Fork districts has increased at a higher rate than during the two years before the law was passed — and the majority of school budgets have proposed tax levy hikes greater than 2 percent.

School administrators and elected leaders blame the increases on mandated pension expenses tied to the downturn in the economy, fluctuations in state aid and facility upgrades.

While state law caps the increased in the tax levy — the total amount school districts can collect from taxpayers — at 2 percent, school districts are allowed to exceed that maximum mandate because the law exempts some expenses, such as pension and capital costs. By factoring in those exemptions, school districts are allowed to raise the tax levy by more than 2 percent without needing to obtain 60 percent voter approval.

While state law caps the increased in the tax levy — the total amount school districts can collect from taxpayers — at 2 percent, school districts are allowed to exceed that maximum mandate because the law exempts some expenses, such as pension and capital costs. By factoring in those exemptions, school districts are allowed to raise the tax levy by more than 2 percent without needing to obtain 60 percent voter approval.

Ten of the 14 budgets proposed in local school districts in the past two years raised the tax levy by more than 2 percent. In the two years prior to that, nine spending plans led to tax hikes above 2 percent. Five years ago, only three of seven budgets featured tax hikes in excess of 2 percent.

Former assemblyman Dan Losquadro (R-Shoreham), whose district covered the North Fork and who worked on the tax cap legislation and pension reform during his two years in office, said he believes the mandate has been successful at controlling spending.

“In the absence of that law, even with the caveats and the carve-outs and the exemptions that do exist within it, I think that the rates would be much higher,” Mr. Losquadro said. “This is the case when something is far better than nothing. It still is keeping every level of government in check, even though it may not necessarily be directly at that 2 percent number.”

This year’s average proposed tax levy increase in school districts across New York State is 4.6 percent, up from about 3 percent a year ago, according to the Empire Center for New York State Policy. No North Fork school district has proposed a tax levy hike above the state average this year.

The average tax levy increase in Suffolk County this year is 3.5 percent, according to the nonprofit’s report, seventh lowest among the 57 counties in the New York State public schools system. Four North Fork districts — Greenport, New Suffolk, Riverhead and Southold — have proposed tax levy hikes above the county average.

Asked if he believed it is misleading to call the law a 2 percent cap, state Senator Ken LaValle (R-Port Jefferson) said school officials sought even more exceptions to the law and the current cap is a “good compromise” to what was debated.

In Southold, Superintendent David Gamberg proposed a $28 million budget for 2013-14 that carries a 3.82 percent spending increase over this year’s plan. The district’s proposed tax levy increase is 4.01 percent, the maximum allowable under the law. He said Southold was able to avoid layoffs and present a budget without piercing the percent allowable increase because it received additional state aid near the final hour of the budget process. The district has been mindful of balancing a budget that taxpayers can afford while preserving student programs, he said.

“I think our average tax levy rate increase over the past six years has been below 2.5 percent and that includes the 4.01 percent for next year,” Mr. Gamberg said. “What that tells us, I believe, when you average it over time, we have been very responsible.”

Mr. Gamberg and other local superintendents have described attempting to pierce the cap as a gamble since most budgets fail to pass with a supermajority.

In order to come in under the allowable cap, many school districts are using more reserves than in prior years to offset the tax levy. School officials have described the cap as having a domino effect, diminishing reserves because less money is available to carry over to their fund balances at year’s end.

Mr. LaValle, who also supported the cap, said he’s noticed some schools in his district have increased spending while staying under the allowable tax cap because they are applying more reserves instead of curtailing expenditures. He’s concerned about districts relying on the one-shot solutions and believes more needs to be done to reduce spending, such as creating shared service agreements between neighboring districts, he said.

“The 2 percent cap now proves that all along they were squirreling money away and putting it in these various reserve accounts,” Mr. LaValle said. “When the music stops, they aren’t going to have chairs anymore … I don’t know what they’re hoping for. Maybe they think the tooth fairy will come into the district and give them money in year four and year five of the 2 percent cap. I just don’t know, but you cannot keep spending at the level that you’re spending — depleting your reserve funds — and when your reserves are gone, then you’re in deep trouble.”

Spending has increased a combined $19.21 million in the seven North Fork school districts since the tax levy cap was passed in 2011. In the two years before the law took effect, spending had increased $10.22 million in those same seven districts.

With a budget of just $5.53 million, the Oysterponds district, serving pre-K through sixth-grade students from Orient and East Marion, is the only North Fork district that has not exceeded the 2 percent tax levy cap in either of the last two years. The district has actually reduced spending by $250,000 in that time.

Mattituck-Cutchogue is the only local district to increase spending over the last two years at a lower rate than during the preceding two years.

The remaining five local districts have increased spending at higher rates since 2011.

Shoreham-Wading River Superintendent Steven Cohen, whose $66.1 million proposed budget for 2013-14 carries a 5.5 percent spending increase over this year’s plan, said services will be preserved through a $1.65 million reduction in costs that don’t affect students’ education, thanks in part to budget adjustments that involved planning for federal grant money.

As for next year’s expenditures, Mr. Cohen said a large chunk of the spending is the result of hikes in state-regulated pension contribution rates.

The district’s contribution to the teacher retirement system jumped 38 percent from last year, he said, while employee retirement contributions rose about 13 percent from 2012-13.

Mr. Cohen said he believes pension costs should be removed from property taxes because school districts and local municipalities don’t have a seat at the table in developing the state’s pension system.

“It’s true that all municipalities and all schools in New York State have to contribute to something they’re told they have to contribute to, so why put that on the property owners?” he said. “We could negotiate contracts. We could negotiate medical expenses. But nobody can touch pensions.”

Mr. Losquadro said he disagrees because he believes school districts and local municipalities indirectly play a part in developing the amounts.

“I think the pension costs as a driver of their overall operation expenses become part of their incentive to negotiate more sustainable contracts,” he said. “You may not control the formula, but you control the numeral that gets plugged into that formula.”

Mr. Losquadro said pension reform passed last year, known as Tier VI, will provide a long-term solution because it puts in place a “sliding scale of people paying in at a higher rate for higher salaries and they pay in for the life of their employment.” He described the legislation as a milestone and said it also places “strict limitations on the pension calculation for overtime, sick and vacation time payouts.”

Under the state constitution, the pension formula that’s in force on the day an employee joins the public retirement system cannot be reduced for the rest of that worker’s public career, according to online records. Since the public pensions are guaranteed, if pension fund investments under-perform in stock markets, it falls on the given taxing entity to make up the difference.

For example, Mattituck-Cutchogue Superintendent James McKenna said his district’s employee pension payment is increasing to 16.25 percent of payroll for 2013-14 , up from this fiscal year’s 11.5 percent of payroll — a one-year jump of $850,000.

Contribution rates are calculated using a five-year average of stock performances, school officials said. The current bracket began in 2008, officials explained, so in the coming years, more recent stock market gains should result in lower contribution costs.

As districts struggled to prepare their spending plans this year, most were able to avoid layoffs, maintain current student programs or offset their tax levies with the addition of unanticipated state aid secured in February.

Although Gov. Andrew Cuomo’s proposed budget released in January cut state aid to each school district in Southold Town, the state Legislature was successful in restoring those funds and even secured additional aid for Riverhead and Shoreham-Wading River.

During the early stages of the budget planning process, the Riverhead school board was able to reach a retirement incentive agreement with its teachers union in order to save enough money to permit a budget under the district’s allowable tax levy rate of 5.14 percent. The school board then agreed to apply $1.16 million of the extra $1.7 million in state aid to cut the proposed tax levy increase down to 3.82 percent.

A significant portion of spending increases in Riverhead and Greenport — where the proposed budget hike is more than $1 million, raising the tax levy by 3.93 percent — has been attributed to recently approved capital improvement projects. Both districts have committed to proposing budgets carrying tax levy increases under the state’s allowable limit, officials have said.

Riverhead school board president Ann Cotten-DeGrasse said she’s hopeful that pension contributions will be reduced in coming years and more state aid will be restored now that the economy is experiencing an uptick.

“We were so appreciative that the community supported the bond to take care of all the things that were in such ill repair that we did not want to appear greedy and say ‘Well, we need more,’ ” she said. “That’s why, when we found out we got additional state aid, we applied the lion’s share to bringing down the tax levy.”

Mr. McKenna of Mattituck-Cutchogue agreed the state aid restoration avoided a “crippling” situation for next year and believes the state needs to maintain its share of funding for schools in order for districts to remain solvent.

Once the Legislature restored state aid, Mr. McKenna said the district was able to close its deficit and propose a 3.28 percent tax levy increase, which is under the district’s 3.65 percent allowable rate. Due to declining enrollment, the district also plans to provide scaled-down versions of some programs and won’t replace five retirees in order to maintain current student services.

As for reducing expenditures, Mr. McKenna, whose proposed $38.85 million budget carries a 2.24 percent spending increase, said he believes the district has been successful at controlling spending even though mandated expenses have gone up.

“After we had our bond [in 2004], I think we’ve worked very, very hard to control our spending,” he said. “I feel we were on a self-imposed tax cap for a while. I think all of us are very conscious of that balancing act of meeting the needs of kids, providing a well-balanced program and trying to make it affordable to taxpayers.”