Guest Column: Local government for sale? It seems so

National debate about corporate campaign contributions is endless and abstract. The discussion becomes manageable and much more real if we look at a small, local example of how the practice damages government and hurts taxpayers.

I’m not suggesting, or even hinting, that anything illegal occurred; that does not make the activity any less noxious or offensive.

While most of the noise during recent discussions of rental permits stemmed from Councilwoman Jodi Giglio’s Summerwind apartments project, a closely related and much more serious issue sailed under the radar: an unneeded and untimely tax cut for the wealthiest among us.

Out of the blue at a work session, the supervisor said hotels should not be subject to the rental permit fees they’ve been paying for a long time. According to this paper’s live coverage of that meeting, no council members challenged this proposal. No one even asked what the tax impact would be, or how we would make up the lost revenue. (Answers: About $20,000 annually and individual taxpayers’ pockets.)

It was back on the agenda a few sessions later. Although stated reasons for the permit discussions were to make dwelling definitions “consistent with state code” and to increase rental fees by two-thirds, what the draft law principally did was give a two-year exemption to new apartments and eliminate all fees for hotels. No justification for the hotel handout was offered, there was again no challenge and no discussion, and the new law is marching toward approval. Why?

HOTEL TAX HISTORY

This tax is easy to track back to 1996, when town code established for commercial hotel/motel businesses fees of $200, every two years, to secure a permit for transient guest rooms. This paralleled fees on residential apartments, the idea being to enable code enforcement to regularly inspect all rentals for safety. In 2006, John Dunleavy and Ed Densieski led a drive to overhaul this chapter of town code. While the focus was on responding to complaints and improving enforcement, the biannual fee for hotels was increased to $500 and a per-room charge was added (again, to match residential apartments).

But thanks to a printing error, the 2006 proposed law change included a typo no one noticed, reducing the tax from $50 per room to $5. The matching per-hotel-room fee was, therefore, set at $5. In 2007, a revision put the decimal back where it belonged. Moving the fee from $5 to $50 for apartments and hotel rooms was the only change in this law. Until now.

At the 2006 public hearings, no one from the hotel industry spoke and written comments consisted of two homeowners supporting the new law and one realtor opposing. The Town Board unanimously approved the law.

In 2007, there were no speakers and no written comments. The Town Board unanimously approved the law.

This fee is in dollars, not percent of income, and hasn’t been adjusted for inflation in nearly a decade. In a 100-room hotel, owners now pay fees under $28 per year, for rooms that typically rent for $100 and up per night. That’s why we haven’t heard “the fee is a hardship” argument. It would sound ludicrous.

Soon, instead of paying higher permit fees — as will individuals who own one or two rental apartments — hotel owners may pay nothing. The $28 per room hotel operators will save each year won’t create new jobs, raise pay for existing employees or lower prices to attract more customers. It will simply boost profits. Why?

BIGGER FAVORS

Sadly, the tax breaks discussed above are chump change. Long-running Industrial Development Agency abatements given to various hotels are more significant, but the really serious money was handed out by these same Town Board members in 2010. When it came to square footage in figuring how much hotels must pay through the town’s transfer of development rights program, hotels were allowed to exclude bathrooms, hallways and closets from size calculations, because “they don’t produce the revenue.” (Would you stay in a hotel without them?)

Looking at only the planned Marriott — already approved — this rule change reduced needed ag credits by over 35 TDRs.

At current prices, the owner saves $2.85 million.

CAMPAIGN MONEY

I won’t speculate publicly on motives, but I pay close attention to facts:

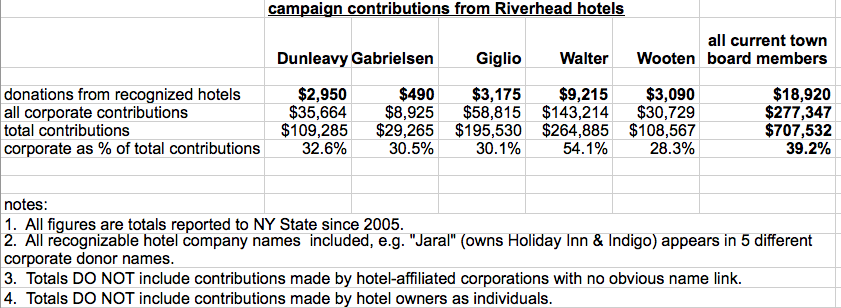

• Since 2005, major hotel owners have given at least $18,920 to the campaigns of our five sitting Town Board members.

• More than half that money directly supported the supervisor, who recently suggested abolishing hotel rental permits.

• Well over half the supervisor’s contributions are corporate. Other board members’ are about 30 percent.

• It’s impossible for elected officials to “forget” thousands of dollars in campaign contributions when deciding on legislation that directly impacts the donors.

Fixing campaign rules to preclude future conflicts is hard, but the injustice described here hasn’t happened yet and is easy to avert. I call on Town Board members to kill this tax cut and instead raise hotel permit fees along with proposed apartment fees. Hotel owners didn’t request this tax break; their businesses are thriving and don’t need it, and already overburdened individual taxpayers would have to make up the lost revenues.

If you agree this is an obscene giveaway, send an email or letter to the Town Board (copy the town clerk): “Update, don’t eliminate, hotel permit fees.”

There’s another message here. Current board members raised over $700,000 in campaign contributions, but George Gabrielsen managed to get elected (and re-elected) with under $30,000, good for just 4 percent of the total (and just 3 percent of the corporate funds).

Some would call this fundraising performance weak. I call it virtuous, and an example of how to abandon the politics of money for the politics of ideas.

Campaign solicitations start soon; let’s tell this story to candidates instead of opening our wallets.

Larry Simms owns a home in South Jamesport and a firm that licenses commercial flooring technology. He is a director of savemainroad.org, an advocacy group dedicated to preserving the character of the Main Road corridor and surrounding areas.

Larry Simms owns a home in South Jamesport and a firm that licenses commercial flooring technology. He is a director of savemainroad.org, an advocacy group dedicated to preserving the character of the Main Road corridor and surrounding areas.